What’s Inside the 1Q 2025 Newsletter:

- A Bumpy Start for Q1, but Diversification Aids When Uncertainty Arises

- Are You Making the Most of Your Catch-Up Contributions?

- Debt After Death: What Happens to Debt When Someone Dies?

For the PDF version of the newsletter, click here.

A Bumpy Start for Q1, but Diversification Aids When Uncertainty Arises

The S&P 500 Index declined 4.3% in the first quarter of 2025, the largest quarterly decline since the third quarter of 2022. The Index’s lackluster start to 2025 after consecutive years of outperformance was driven by a mix of headwinds to economic growth and policy uncertainty. In domestic markets, value stocks outperformed growth stocks, posting a gain for the quarter. Small capitalization stocks underperformed their large capitalization counterparts. Quarterly market movements were influenced by shifts in policy associated with the new presidential administration, which took office on January 20, 2025. February was particularly volatile as markets adjusted to policy uncertainties, alongside softening economic data throughout the quarter. Tariffs and government spending cuts dominated the domestic headlines while geopolitical uncertainty resulted in strong investor demand for international equities. The Federal Reserve Open Market Committee (FOMC) had two meetings and held interest rates at both meetings, finishing the quarter with a federal funds target rate range of 4.25% – 4.50%. The U.S. Economy remained resilient, even in the wake of the short-term volatility. Corporate earnings were strong, though analysts have begun to re-rate forecasts a bit due to tariffs.

International equities outperformed domestic equities in the first quarter of 2025. The MSCI EAFE Index gained 7.03% in the quarter, while the MSCI Emerging Markets Index returned 2.97%. Europe saw a strong equity rally following Germany’s relaxation of debt rules to fuel defense spending, and the fiscal spending driving rearmament of Europe resulted in strong quarterly outperformance versus the world.

In fixed-income markets, a key development in the first quarter was the ongoing normalization of the yield curve. Short-term yields continued their downward trajectory, contributing to a notable outperformance of Treasuries relative to equities as investors sought stability amid market volatility. The 10-year Treasury yield fell by over 0.30% in the period from 4.57% up to 4.23%. In a positive quarter for bonds across the board, high-yield corporates slightly outperformed their investment-grade counterparts.

Condor Capital’s Outlook

Looking ahead, investors will be closely monitoring the economic data and policy developments coming out of Washington D.C. While inflation improved over 2024, the implementation of tariffs at the end of the quarter and the uncertainty surrounding the trajectory of tariff policy moving forward could be a headwind to economic growth in the near term. Overall, the labor market has remained resilient, and consumers are still continuing to spend at a healthy rate.

Corporate earnings growth remains a critical driver of the stock market, and while 2025 prospects initially appeared robust, recent shifts in estimates have tempered expectations. S&P 500 earnings grew by 9.5% in 2024, reflecting a strong business environment, but 2025 projections have been revised downward from an optimistic 14.8% to a more modest 11.2% as of Q1 2025, according to updated consensus estimates. Should corporate earnings growth hit even these lower revised estimates, it would still represent an incredible year of earnings growth, but the size of recent revisions does speak to the challenges of tariff impacts and economic uncertainty. This volatility and uncertainty have impacted full-year U.S. GDP growth estimates as well, with the Atlanta Fed’s GDPNow model revising its Q1 projection downward to show negative growth.

However, some sources like Deloitte and The Conference Board continue to forecast a more optimistic outlook. This speaks to an important fact, which is that tariff increases are not happening in a vacuum. Corporate balance sheets are generally healthy, and there should be room for negotiations and at least incremental supply chain tweaks. Additionally, there is a strong case that the benefits of Artificial Intelligence (AI) enhancements are yet to be fully felt. Thus far, the market benefits of AI have largely been contained to the mega-cap tech firms that produce the chips and models powering AI, whereas the productivity and profitability improvements to the end-user firms of AI should begin to show themselves more moving forward. More optimistic forecasters like Deloitte and The Conference Board cite these potential productivity improvements as a factor in their more bullish assessments. If there is any movement on the other side of the Trump administration’s economic agenda, namely reduced regulatory barriers and lower corporate tax rates, that would be a real positive catalyst to offset some of the recent pain from tariffs. Finally, the Federal Reserve and the country’s interest rate policies factor in as well. With rates in the 4.25% – 4.5% range, there is room to ease if the Fed were to try to get out ahead of any economic uncertainty.

We cannot predict political outcomes and would hesitate to do so especially in the current environment, but President Trump considers himself a dealmaker and has historically viewed stock market performance as a barometer of an administration’s success. We expect many nations will come forward to negotiate on trade, and those discussions could lead to lowered global trade barriers. This aspect is especially important to note due to the speed at which things can change here. As we saw on April 9th, the administration’s move to roll back most tariffs sent the market up by over 6% in the span of an hour. Any further deals or negotiations, particularly with China, could be similarly sudden. Trying to time the market in an environment like this could be especially costly. As always, we will continue to monitor this evolving environment in a disciplined, opportunistic manner.

Are You Making the Most of Your Catch-Up Contributions?

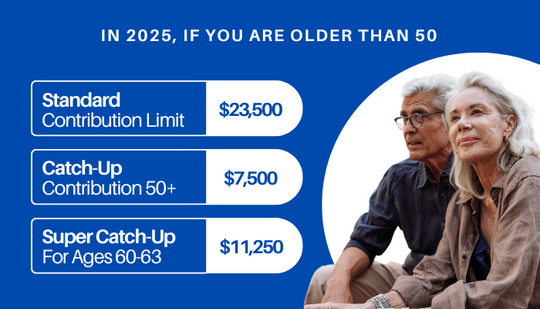

The SECURE Act 2.0 has introduced catch-up contribution choices for those aged 50+, designed to help boost your retirement savings.

These enhanced catch-up provisions are available if you’re participating in workplace retirement plans like 401(k)s, 403(b)s, governmental 457 plans, and the federal government’s Thrift Savings Plan—this follows other SECURE Act 2.0 changes, including revised Required Minimum Distribution (RMD) ages and expanded access to 401(k) plans for part-time employees.1

The standard annual contribution limit for workplace retirement plans is reviewed annually and adjusted for inflation if necessary. Beyond this base limit, catch-up contributions allow those 50 and older to save additional amounts. From age 60, an even higher “super catch-up” contribution becomes available, which took effect in 2025.2,3

Here’s what you need to know about the different contribution tiers:

- Standard annual contribution limit: $23,500 for 2025 (up from $23,000 in 2024, adjusted annually for inflation).

- Age 50+ catch-up contribution: An additional $7,500 is available for those 50 and older, allowing total contributions of up to $31,000 annually.

- Age 60-63 “super catch-up” contribution: A significantly higher limit of $11,250 for those specifically aged 60-63 (replacing the standard $7,500 catch-up), enabling total annual contributions of up to $34,750 during these peak earning years.

- SIMPLE plan participants: The standard contribution limit is $16,500 for 2025, with a regular catch-up of $3,500 for those 50+ and an enhanced super catch-up of $5,250 for those 60-63.

- For regular Individual Retirement Accounts (IRAs), the annual contribution limit is $7,000 for 2025, with an additional $1,000 catch-up amount available for those over age 50.

Forecasts are based on assumptions and are subject to revisions over time. Financial, economic, political, and regulatory issues may cause the actual results to differ from the expectations expressed in the forecast.

Once you reach age 73, you must begin taking required minimum distributions (RMDs) from your 401(k) or other defined contribution plans in most circumstances. Withdrawals from your 401(k) or other defined contribution plans are taxed as ordinary income and, if taken before age 59½, may be subject to a 10% federal income tax penalty.

Once you reach age 73, you must begin taking RMDs from a traditional IRA in most circumstances. Withdrawals from traditional IRAs are taxed as ordinary income and, if taken before age 59½, may be subject to a 10% federal income tax penalty.

1. IRS, November 2024

2. Investopedia, November 2024

3. Voya Financial, December 2024

Debt After Death: What Happens to Debt When Someone Dies?

Losing a loved one is never easy. In addition to the emotional challenges you may face, you might also be worried about what will happen to their debts once they are gone.

Generally, with limited exceptions, when a loved one dies you will not be liable for their unpaid debts. Instead, their debts are typically addressed through the settling of their estate.

How are debts settled when someone dies?

The process of settling a deceased person’s estate is called probate. During the probate process, a personal representative (known as an executor in some states) or administrator if there is no will, is appointed to manage the estate and is responsible for paying off the decedent’s debts before any remaining estate assets can be distributed to the beneficiaries or heirs. Paying off a deceased individual’s debts can significantly lower the value of an estate and may even involve the selling of estate assets, such as real estate or personal property.

Debts are usually paid in a specific order, with secured debts (such as a mortgage or car loan), funeral expenses, taxes, and medical bills generally having priority over unsecured debts, such as credit cards or personal loans. If the estate cannot pay the debt and no other individual shares legal responsibility for the debt (e.g., there is no cosigner or joint account holder), then the estate will be deemed insolvent and the debt will most likely go unpaid.

Estate and probate laws vary, depending on the state, so it’s important to discuss your specific situation with an attorney who specializes in estate planning and probate.

What about cosigned loans and jointly held accounts?

A cosigned loan is a type of loan where the cosigner agrees to be legally responsible for the loan payments if the primary borrower fails to make them. If a decedent has an outstanding loan that was cosigned, such as a mortgage or auto loan, the surviving cosigner will be responsible for the remaining debt.

For cosigned private student loans, the surviving cosigner is usually responsible for the remaining loan balance, but this can vary depending on the lender and terms of the loan agreement.

If a decedent had credit cards or other accounts that were jointly held with another individual, the surviving account holder will be responsible for the remaining debt. Authorized users on credit card accounts will not be liable for any unpaid debt.

Are there special rules for community property states?

If the decedent was married and lived in a community property state, the surviving spouse is responsible for their spouse’s debt as long as the debt was incurred during the marriage. The surviving spouse is responsible even if he or she was unaware that the deceased spouse incurred the debt.

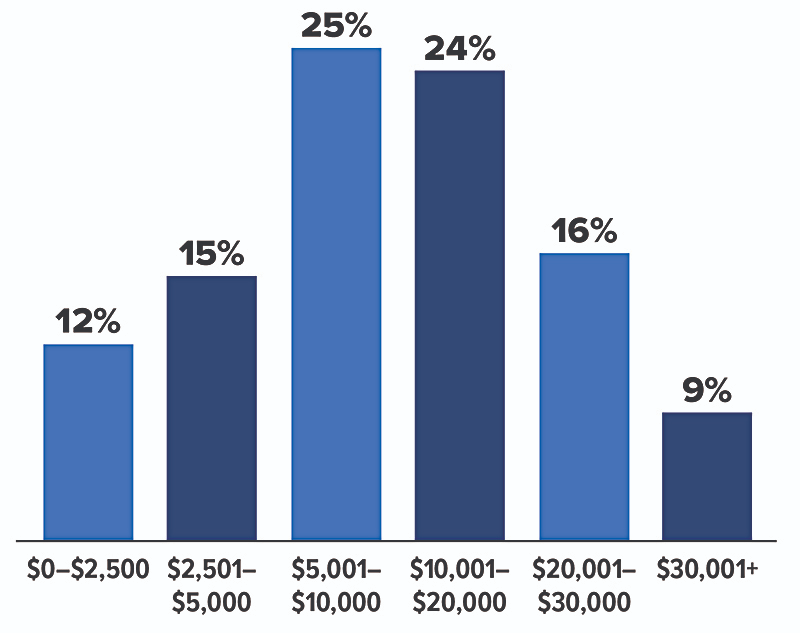

How much debt Americans expect to leave behind when they die

Source: Debt.com Death and Debt Survey, 2024

Can you be contacted by debt collectors?

If you are appointed the personal representative or administrator of your loved one’ s estate, a debt collector is allowed to contact you regarding outstanding debts. However, if you are not legally responsible for a debt it is illegal for a debt collector to use deceptive practices to suggest or imply that you are. Even if you are legally responsible for a debt, under the Fair Debt Collection Practices Act (FDCPA), debt collectors are not allowed to unduly harass you.

Finally, beware of scam artists who may pose as debt collectors and try to coerce or pressure you for payment of your loved one’s unpaid bills.